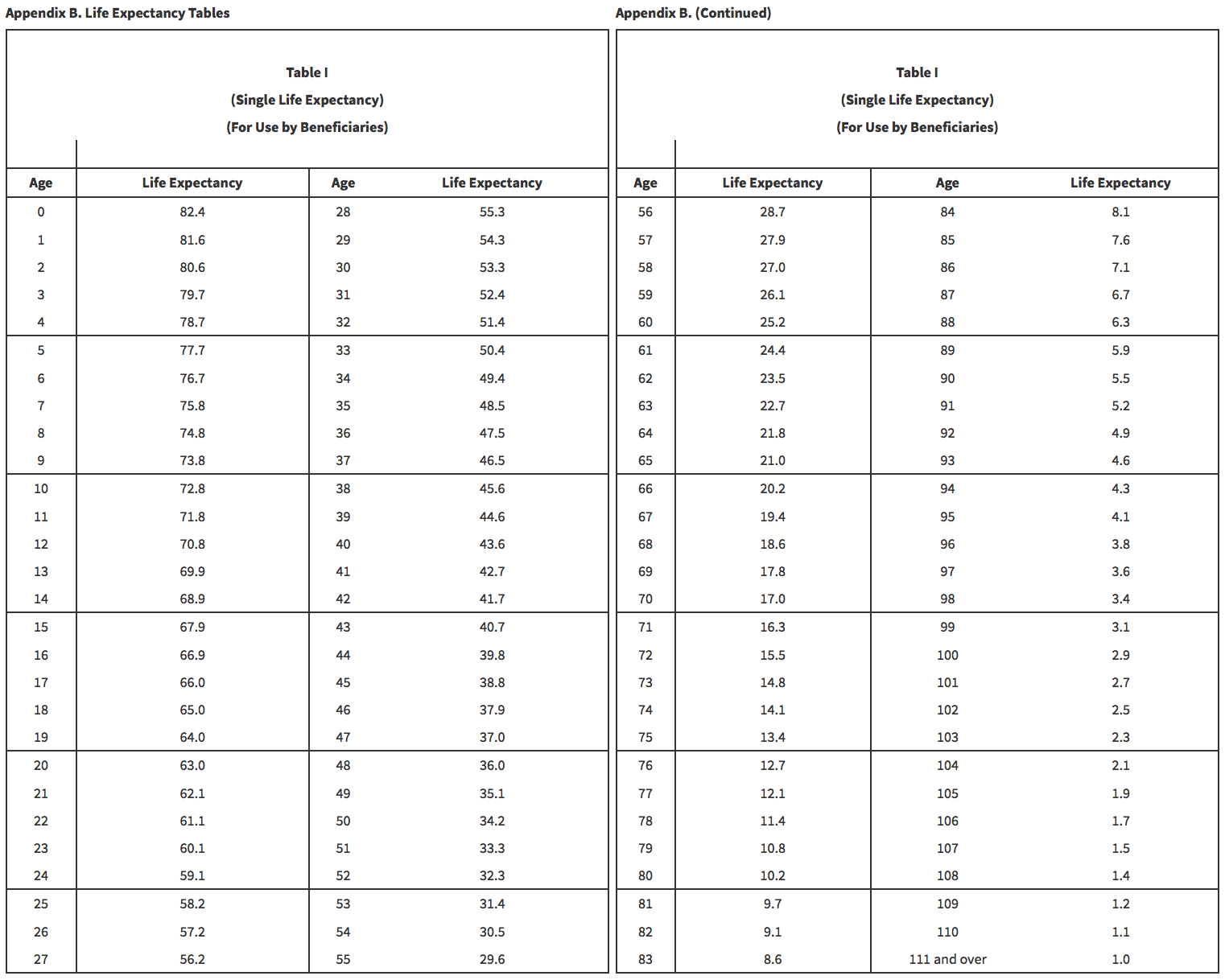

Irs Life Expectancy Table 2025 Inherited Ira - Rmd Tables For Inherited Ira Matttroy, The single life expectancy table; When a spouse maintains the ira as an inherited ira, he or she must use the single life table to calculate the rmd based on his or her own or their deceased spouse's life expectancy. Irs Life Expectancy Table 2025 Inherited Ira. That factor is reduced by one for each succeeding distribution year. If the deceased wasn’t yet taking his or her own required minimum distributions and the estate (not an individual) was listed as the direct beneficiary of the ira, the account must be emptied within five years.

Rmd Tables For Inherited Ira Matttroy, The single life expectancy table; When a spouse maintains the ira as an inherited ira, he or she must use the single life table to calculate the rmd based on his or her own or their deceased spouse's life expectancy.

Rmd Calculation Table For Inherited Ira, The irs has just waived some inherited ira rmds again for 2025. Learn the required minimum distributions for your designated ira beneficiaries.

What Do The New IRS Life Expectancy Tables Mean To You? — Forbes Irs, If the spouse remains a beneficiary of the ira, the irs single life expectancy table is also used, but the deceased’s age is used for calculations instead of the inheriting spouse. Spouse beneficiaries who do not elect to roll the ira over or treat it as their own also use the single life table, but they can look up their age each.

Use our inherited ira calculator to find out if, when, and how much you may need to take, depending on your age.

Annuity Life Expectancy Table, You’d divide your balance by your life expectancy factor (21.1) to calculate a required minimum distribution of $47,393.36. You must withdraw at least this amount to avoid a hefty.

1, 2022, a later rmd trigger age of 72 takes effect.

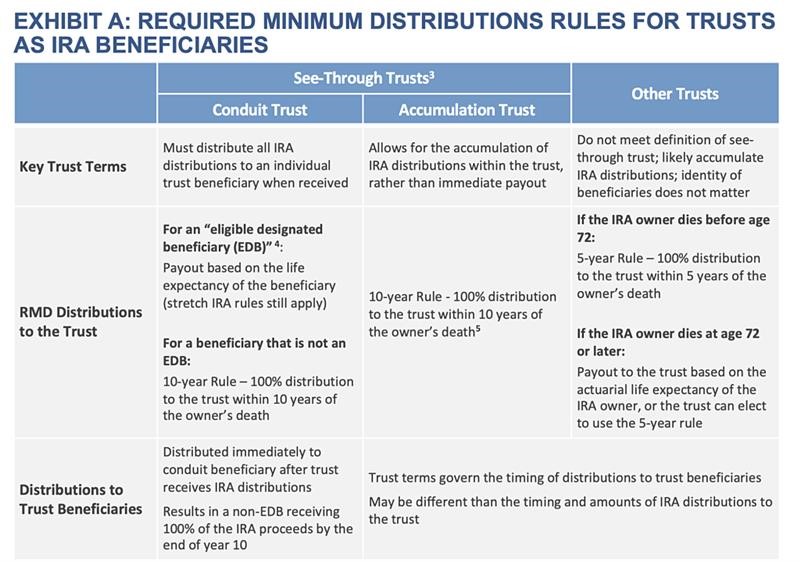

Required Minimum Distribution Table For Inherited Ira Elcho Table, (scroll down to see our calculator.) Previously, if you inherited an ira account, the annual required minimum distribution (rmd) was typically based on your life expectancy.

The irs publishes three different life expectancy tables, two of which are relevant to spousal beneficiaries: You’d divide your balance by your life expectancy factor (21.1) to calculate a required minimum distribution of $47,393.36.

Irs Life Expectancy Tables 2025 Gene Jaquith, Designated beneficiaries use this single life expectancy table based on their age in the year after the ira owner’s death. If the spouse remains a beneficiary of the ira, the irs single life expectancy table is also used, but the deceased’s age is used for calculations instead of the inheriting spouse.

2025 Inherited Ira Rmd Calculator Lissy Phyllys, When a spouse maintains the ira as an inherited ira, he or she must use the single life table to calculate the rmd based on his or her own or their deceased spouse's life expectancy. If you must use table i, your life expectancy for 2025 is listed in the table next to your age as of your birthday in 2025.

Irs Joint Life Expectancy Table 2025 Marlo Shantee, Avoid rmd shortfalls with these 5 top rules on life expectancy. When a spouse maintains the ira as an inherited ira, he or she must use the single life table to calculate the rmd based on his or her own or their deceased spouse's life expectancy.

What Do The New IRS Life Expectancy Tables Mean To You? in 2021, This table is the life expectancy table to be used by all ira owners to calculate lifetime distributions unless your beneficiary is your spouse who is more than 10 years younger than you. If you must use table i, your life expectancy for 2025 is listed in the table next to your age as of your birthday in 2025.

Irs Life Expectancy Tables For Inherited Ira, When a spouse maintains the ira as an inherited ira, he or she must use the single life table to calculate the rmd based on his or her own or their deceased spouse's life expectancy. If the deceased wasn’t yet taking his or her own required minimum distributions and the estate (not an individual) was listed as the direct beneficiary of the ira, the account must be emptied within five years.