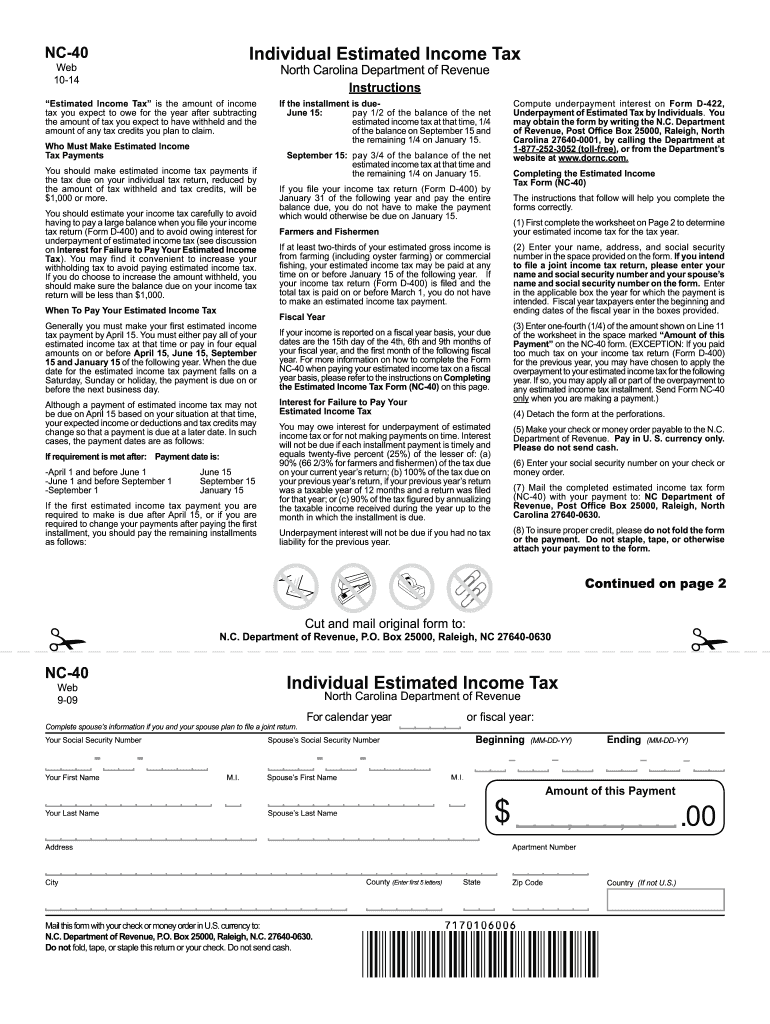

2025 Colorado Estimated Tax Payments - Colorado Estimated Tax Payment Form DR 0104EP, If companies wish to wait and make the election and payment, they can make a payment on the pte filing form. Attention, all taxation division offices will close at 3 p.m. 2025 Form 1120 W Printable Forms Free Online, Estimated quarterly tax payments are due four times per year, on. Individual tax deadline for colorado 2025.

Colorado Estimated Tax Payment Form DR 0104EP, If companies wish to wait and make the election and payment, they can make a payment on the pte filing form. Attention, all taxation division offices will close at 3 p.m.

2025 Colorado Estimated Tax Payments. The deadline for filing a colorado state tax return is april 15, 2025. Learn more about each tax type and.

If you aren’t having taxes withheld from your paycheck, estimated quarterly taxes may be for you. You must file & pay.

Nc Department of Revenue Estimated Tax Payment Form Fill Out and Sign, Updated for 2025 with income tax and social security deductables. Estimated payments can be made on the composite filing voucher, form dr 0106 ep.

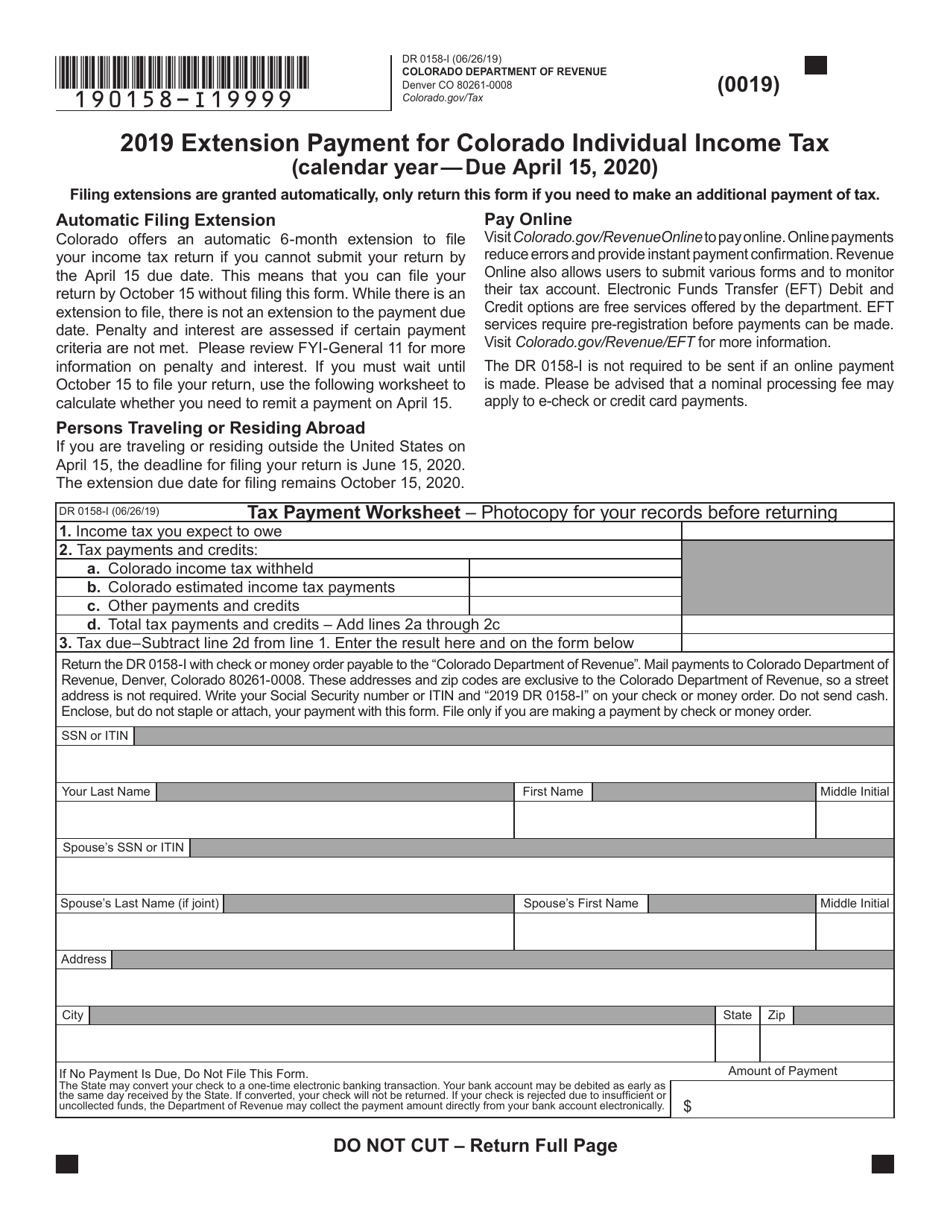

Colorado withholding form Fill out & sign online DocHub, This interview will help you determine if you’re required to make estimated tax payments for 2025 or if you meet an exception. You must file & pay.

When Are Irs Quarterly Payments Due 2025 Melli Siouxie, Before turning your attention to 2025, the final estimated tax payment of 2025 is due on january 16th, 2025. This interview will help you determine if you’re required to make estimated tax payments for 2025 or if you meet an exception.

If companies wish to wait and make the election and payment, they can make a payment on the pte filing form.

See what you need to know about estimated tax payments.

Form DR0158I Download Fillable PDF or Fill Online Extension Payment, The colorado state tax calculator (cos tax calculator) uses the latest federal tax tables and state tax tables for 2025/25. See what you need to know about estimated tax payments.

For instructions on how to compute estimated income tax, see the worksheet provided on the dr 0104ep form.

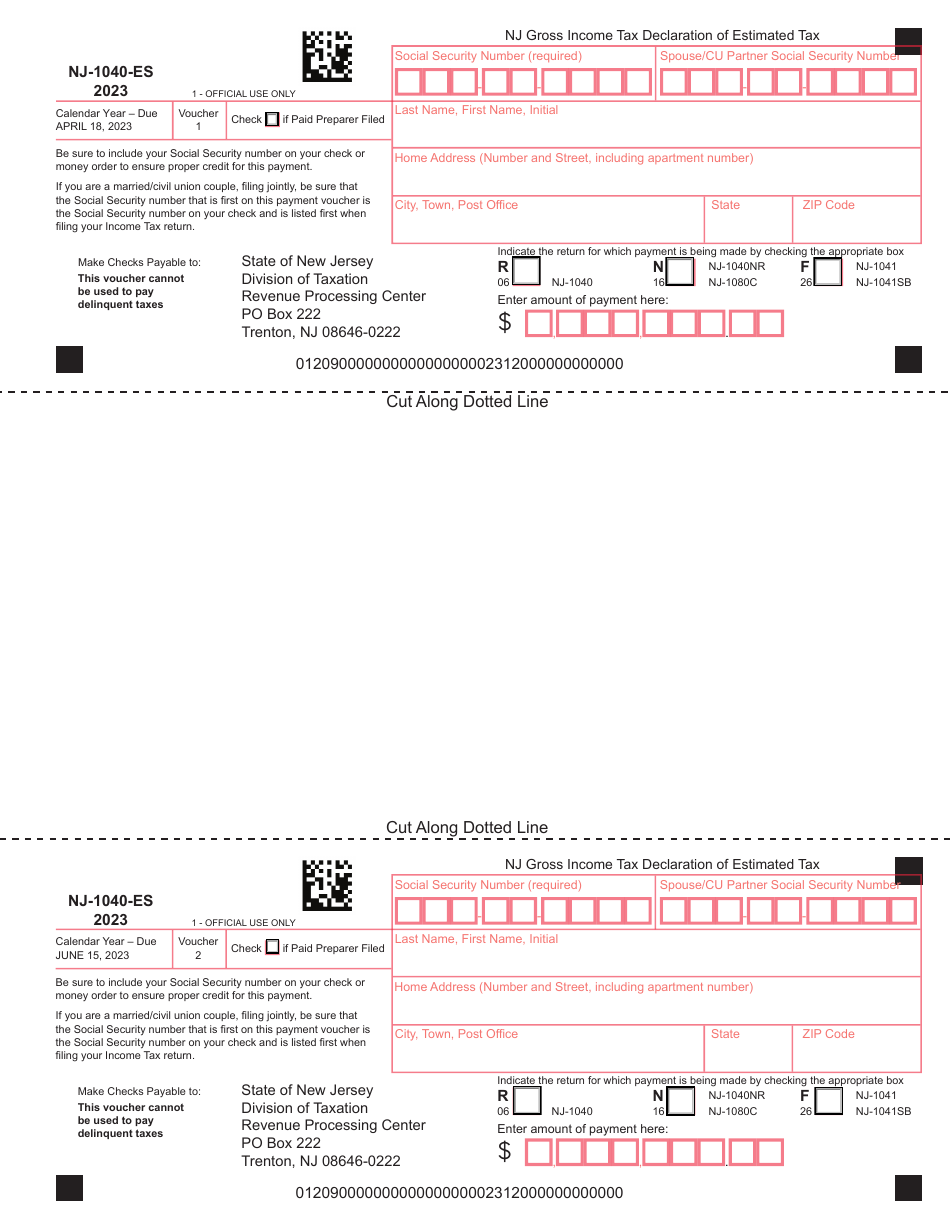

Nj 2025 Estimated Tax Form Printable Forms Free Online, Each tax type has specific requirements regarding how you are able to pay your tax liability. Before turning your attention to 2025, the final estimated tax payment of 2025 is due on january 16th, 2025.

Corporate Estimated Tax Payments 2025, Offices will reopen at their normal times on friday, may 10. If companies wish to wait and make the election and payment, they can make a payment on the pte filing form.

Irs Calendar 2025 Refund Heidi Mollee, For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines. However, you must pay 90 percent of.

How to calculate estimated taxes 1040ES Explained! {Calculator, How to make a payment using revenue online. In most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2025, after subtracting any withholding or credits you might have.